Beyond Spreadsheets: Why Banks Need Modern Lead Management Systems

For decades, banks have relied on spreadsheets to manage inquiries, loan applications, and customer data. While spreadsheets were once a convenient solution, today’s competitive banking landscape demands speed, accuracy, and personalization—things traditional methods simply can’t deliver.

The Problem with Spreadsheets in Banking

-

- Manual Errors – One wrong entry can cost a customer or delay a loan.

-

- Scattered Data – Customer information spread across multiple sheets makes it hard to get a clear view.

-

- Slow Responses – By the time staff updates a sheet, the customer may have already chosen another bank.

-

- Limited Collaboration – Teams can’t efficiently share or update leads in real time.

Clearly, banks need to move beyond spreadsheets.

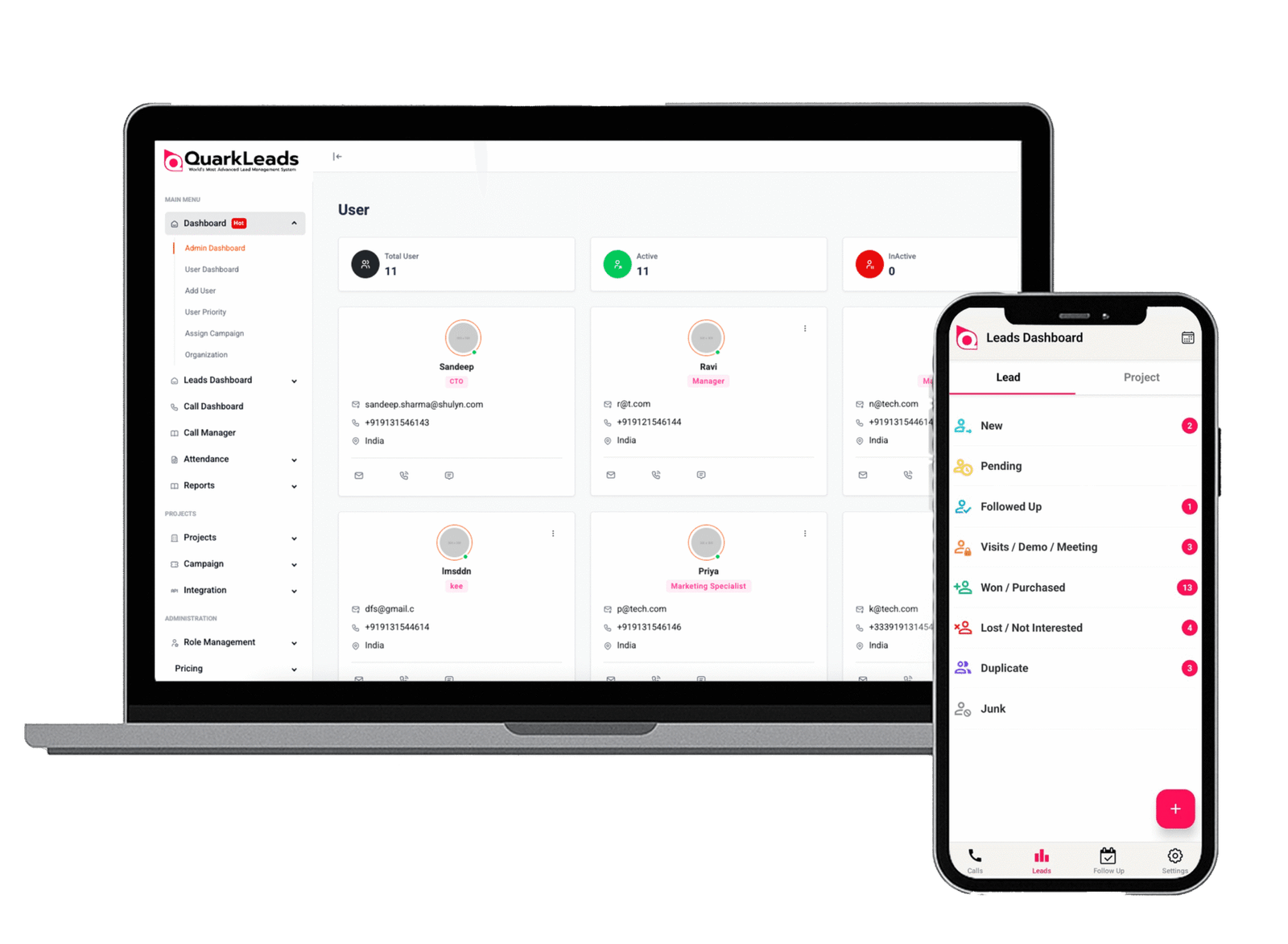

Enter the Modern Lead Management System (LMS)

A modern LMS isn’t just a tool—it’s a game-changer for banks. Instead of juggling scattered data, it:

- Captures all leads automatically from websites, campaigns, and branches.

- Assigns them instantly to the right relationship manager.

- Tracks every interaction—calls, emails, meetings—in one secure platform.

- Provides insights on which services customers are most interested in—loans, credit cards, or savings accounts.

With an LMS, banks can shift from reactive data entry to proactive customer engagement.

Key Advantages of QuarkLeads for Banks

- Instant Call Connection – The moment a customer fills out a loan or account inquiry form, your team can connect instantly, making the first impression count.

- Automated Follow-Ups – Automated SMS, emails, or call reminders ensure no customer feels ignored, boosting engagement.

- Lead Scoring & Prioritization – QuarkLeads highlights high-value leads (like customers ready for loans) so teams can focus on what matters most.

- Centralized Dashboard – One place for all inquiries across branches, campaigns, and digital platforms. No more juggling multiple sheets

Conclusion

Banks can no longer afford to rely on outdated spreadsheets to manage customer relationships. A Modern Lead Management System like QuarkLeads ensures leads are not just collected but engaged, nurtured, and converted into loyal customers.

With QuarkLeads, banks get:

Faster responses

Better loan and account conversions

Higher customer satisfaction

Data-driven growth strategies

Go beyond spreadsheets. Upgrade your banking experience with QuarkLeads—the future of lead management.